You will be in contact with the Danish authorities in many aspects of your stay and therefore we have compiled most of the information you need on this page.

A bit boring but important

This part of how to Denmark should provide you with all the necessary information for you to be able to focus on other aspects of your stay.

NemID

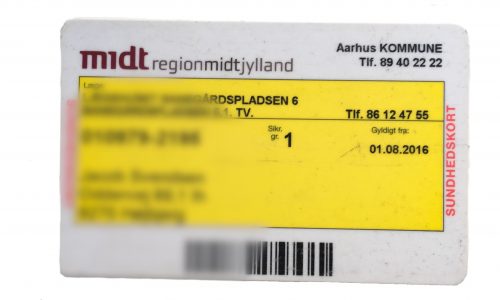

Yellow Health Card

Denmark has an extensive public healthcare system that offers free consultation and treatment at a local general practitioner, emergency wards and public hospitals. When you have received your residence permit or residence card then you are covered by the Danish health insurance system. Most examinations and treatments are free, but you need to register at the authorities to get a health insurance card (the yellow health card).

The health insurance card is documentation that you are entitled to the services offered under the national health insurance scheme.

Go to your local citizen service centre to apply for your yellow health card.

Be aware that at many educational institutions they host an event during their intro days where you can apply for a residence certificate and a cpr number at the same time. This normally cuts two weeks of the waiting time.

Foreign driving license

Exchange students:

If you are here as an exchange student and you do not have personal relations to Denmark, you may either use your foreign driving license or apply for a visitor’s driving license.

Full degree students:

If you are here as a full degree student you may in some cases exchange your foreign driving license for a Danish driving license and in other cases you must complete a driving test (consisting of a theoretical and a practical part) prior to the exchange. Whether you need to complete a driving test depends on the country/constituent state which has issued your driving license.

You must be aware that different rules apply as how long you can wait until you must exchange your foreign driving license for a Danish driving license.

Residence permit

Non-EU/EEA citizens:

As a non-EU/EEA citizen you may be granted a Danish residence permit to study in Denmark.

To be granted a residence permit you must prove that:

- you has been accepted as a student to a higher education course/programme at a university, college or institute that has been approved by the Danish government.

- You can support yourself financially for the duration of your stay. If you are to pay a tuition fee for studying in the educational programme and if you have already paid tuition for the first semester, this is seen as documentation that you have sufficient funds. In this case you do not need to provide additional documentation.

- You must be able to speak and understand the language of instruction this is either Danish, Swedish, Norwegian, English or German with a reasonable level of proficiency.

Make sure that you apply well in advance of commencement of your course as the normal processing time for a residence permit is two months and in some cases it might take longer.

EU/EEA and Swiss citizen:

As an EU/EEA and Swiss citizen you must within three months upon your arrival in Denmark apply for a residence certificate at the Danish Agency for International Recruitment and Integration (https://nyidanmark.dk/en-GB/Contact-us/Contact-SIRI/SIRI-branches). When you apply you must bring your passport, two passport photos and your letter of admission.

Be aware that at many educational institutions they host an event during their intro days where you can apply for a residence certificate and a cpr number at the same time. This normally cuts two weeks of the waiting time.

Pension

Your pension is paid for by yourself, the government and maybe your employer. In Denmark you receive state pension from the state of Denmark, however a lot of people also choose to deposit money to a pension company.

In some cases your employer deposits money for your pension, but that depends on your contract and terms of employment.

Good to know: ATP (ATP lifelong pension) is a pension scheme enforced by law. ATP secures that you get extra pension besides your state pension. ATP is automatically paid to you when you reach the pension age.

Furthermore you have the possibility to set up an individual pension scheme. For that you need a private pension company. There are a lot of private pension companies in Denmark and they are often connected to a bank.

However, special rules may apply to you if you have lived in an EU/EEA member state, Switzerland or a country with which Denmark has concluded a special agreement.

Be aware that you are only entitled to the Danish state pension if:

- you are a Danish national

- You are resident in Denmark

- You have lived in Denmark for three years within the period from you reached the age of 15 till you reach the state pension age

Changing your adress

About paying taxes

All citizens use the public sector in some way, and as a general principle all citizens must thus help pay for it. The tax funds are used to pay for the different expenses that Danish society has such as welfare benefits, state pension, child benefits and for public institutions such as schools, hospitals, libraries and the police.

The Danish tax system is progressive. This means that the higher your income is, the more taxes you must pay. In many other countries citizens pay less tax than in Denmark, but in return they must pay to go to school, to the hospital, the doctor’s, etc. Denmark has its own Minister of Taxation, Ministry of Taxation and its own taxation laws (source SKAT.dk).

Whether you have an income because of a job or because you receive SU (State Education Support) it is good idea to know the basic tax rules. If you receive a Danish scholarship you might be tax exempted, this is something that your educational institution can help you with.

It is always important that you inform SKAT about changes in your income, such as if you stop studying, start working, receive SU or start up your own company. This way you make sure that you do not pay more in tax than you should and at the same time you avoid having to pay back tax the forthcoming year.

Tax card

Make sure that you have a valid tax card and/or make sure that your tax card has been updated on your income. You should also make sure that your primary tax card is used by your primary source of income. If you receive SU your primary tax card will be used for your student grant.

Your primary tax card is also where you find your personal allowance.

Personal allowance

This is an amount of money that you can earn without paying tax. The allowance is automatically calculated into your tax calculations. In 2018 the personal allowance for the full year amounts to DKK 46.000.

Employment allowance

If you have a student job you are also eligible for an employment allowance, this employment allowance is calculated automatically. This allowance cannot exceed DKK 30.400.

Assessed deductions

The amount of tax you have to pay is calculated after certain amounts are deducted from your income, e.g. trade union fees, interest expenses and transport to/from your work in excess of 24 km.

The more and higher the amounts you can deduct, the lower your taxable income will be and the less tax you will have to pay.

As a foreign student you will typically only have one assessed deduction, the deduction for transport between home and work exceeding 24 km per day.

Most allowances and deductions are automatically stated in your preliminary income assessment and tax assessment notice. If not, you can change your preliminary income assessment and tax assessment notice.

A-tax (tax deducted from income at source)

This is tax deducted directly from your income. Income tax is collected during the year by your employer, pension provider, etc. withholding part of your salary or pension before it is disbursed. This also includes property value tax based on the public property assessment. The amount withheld is paid to the Danish Tax Agency (Skattestyrelsen) as provisional tax. At the end of the year, a calculation is made to determine whether the amount paid is more or less than the tax payable for the whole year.

Labour market contributions (AM bidrag)

All working citizens must pay labour market contributions. Your employer will deduct the contributions from your pay. Labour market contributions are used for the Government’s labour market expenses, for example to cover unemployment benefits, supplementary training courses and maternity. It should be noted that the labour market contributions are actually a tax, deducted from employees’ gross pay, or self-employed persons’ income from self-employment.

Holiday allowance

You might have received a letter from feriepengeinfo (information regarding holiday allowance) that states that you have holiday allowance owing to you.

If you have a contract where the term of notice is at least a month and where you receive your pay under sickness and on bank holidays your holiday allowance is paid like regular salary.

However if you have a job where you don’t have a right for pay on bank holidays or under sickness and/or a notice of at least a month the holiday allowance is handled as follows (if it is FerieKonto who handles the holiday allowance):

- You cannot receive your holiday allowance before May 1, as the holiday year starts on May 1.

- You receive your holiday allowance four weeks before planned holiday at the earliest.

- If you ask for holiday pay less than four weeks before the first day of your holidays, you will receive the holiday allowance on your NemAccount within four bank days.

- If you have earned less than DKK 1500,- in holiday allowance you will receive your holiday allowance in the beginning of the new holiday year on your NemAccount.

Be aware that the holiday year runs from May 1 to April 30, and you earn the right to holiday allowance from January 1 to December 31. This means that the holiday year that began on May 1 last year is linked to the this calendar year.

There might be other rules regarding your holiday allowance if it is handled by another agency than Feriekonto.

Did you know that your “sygesikringsbevis” (Your National Health Insurance card) also is valid as a library card?

To take control of your life you need lots of information. We believe that when you are in the frontseat of your life it is much easier to settle down in a new place, in a new country.

– How To Denmark

NemID is your way to get access

NemID is used for public authorities’ self-service, online-banking and a lot of private websites.