This is how it works

You must have lived or worked in Denmark for a certain period within the last 10 years. You can also include periods during which you have accrued family benefit rights by living in or working in another EU or EEA country or Switzerland. You can do so if you are a citizen of an EU/EEA country or Switzerland. However, Udbetaling Danmark – Public Benefits Administration – first need to verify your information with the authorities in the country in which you have lived or worked before the periods can be included.

Were you entitled to receive child benefits before 1 January 2018?

If you received child benefits before 1 January 2018 and if you are still entitled to receive child benefits, you are subject to a two-year qualification requirement. This means that you must have lived or worked in Denmark for at least two years within the past 10 years.

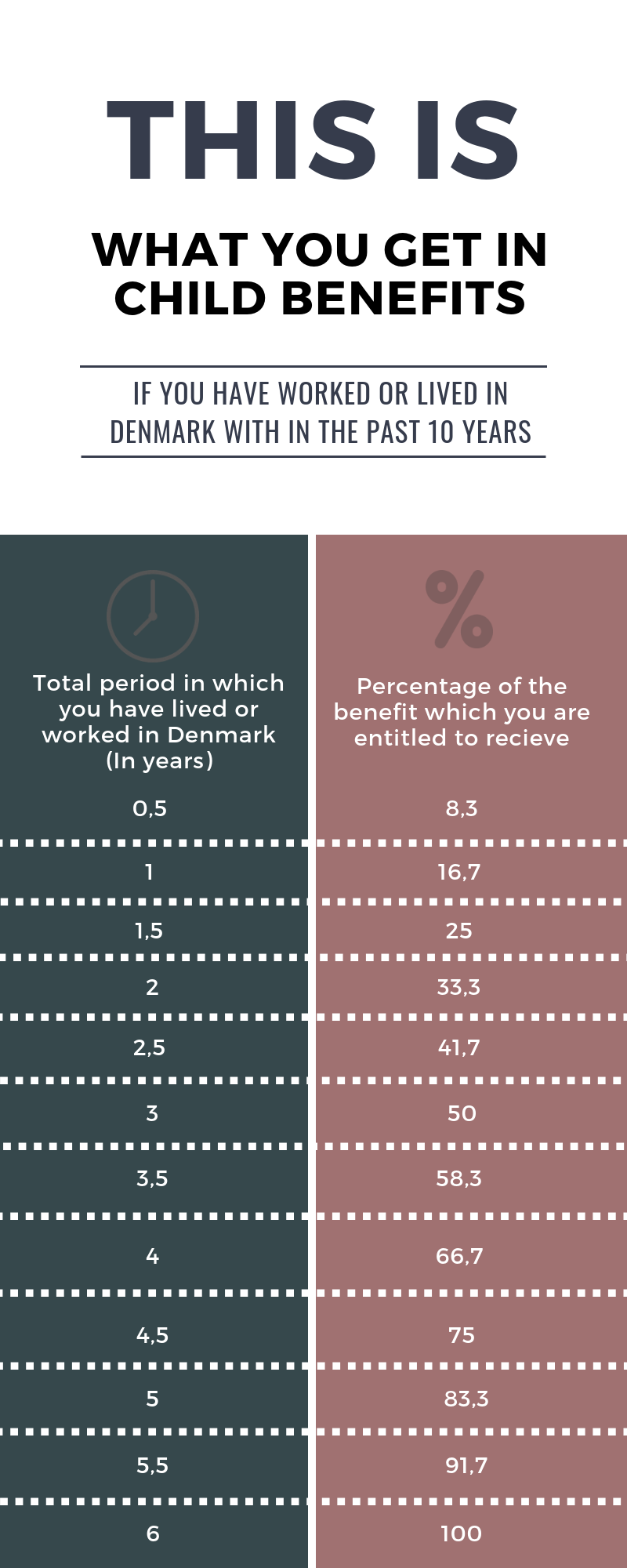

Below, you can see the percentage you are entitled to receive, depending on how long you have lived or worked in Denmark, in Greenland or on the Faroe Islands within the past 10 years.

- 1, 5 years in order to have earned 25 per cent of the total benefit

- 3 years in order to have earned 50 per cent of the total benefit

- 4,5 years in order to have earned 75 per cent of the total benefit

- 6 years in order to have earned the total benefit.

Here are the rates for child benefits:

- 0-2 years old = DKK 4.506 every quarter

- 3-6 years old = DKK 3.567 every quarter

- 7-14 years old = DKK 2.808 every quarter

- 15-17 years old = DKK 936 every quarter